It is important to note that the income figures are based on your adjusted gross income (income after deductions and exemptions). This means that as your income increases the tax bracket you are in changes, which effects how much income tax you will pay. The income tax brackets in California are progressive. How California State Income Tax Brackets Work If the amount you paid in estimated taxes or the amount you had withheld was more than the amount you were required to pay, you may be due a refund. For those that made estimated tax payments throughout the year or withheld California state income taxes from their paychecks, you can subtract the amount paid or withheld from the amount of state tax you were required to pay. Once you have this information, you can then enter it into the calculator to find out how much California State income tax you are required to pay.

Your taxable income can be found on line 19 of form 540 or 540-NR. How Much California State Income Tax Will You PayĬalculating how much state income tax you are required to pay can be done by using the FTB Tax Calculator but, you will need the following information: To see the income thresholds for filing see California Resident Income Threshold for Filing or California Part-Year or Non-Resident Income Threshold for Filing. You earned over a certain amount of income.įor additional information about personal filing requirements visit the FTB’s Personal Filing Information page.You received income from a source in California.You are required to file a federal income tax return.Whether you are a resident, part-year resident, or non-resident of California you may be required to file a California state income tax return if the following are true: For more information on the FTB see our blog California Franchise Tax Board – FTB Collections. Though the FTB does serve other functions their main purposes is to assess and collect state income tax for California.

#State of ca tax brackets 2019 code#

The FTB is the state taxing authority responsible for enforcing the Revenue Tax Code for the State of California.

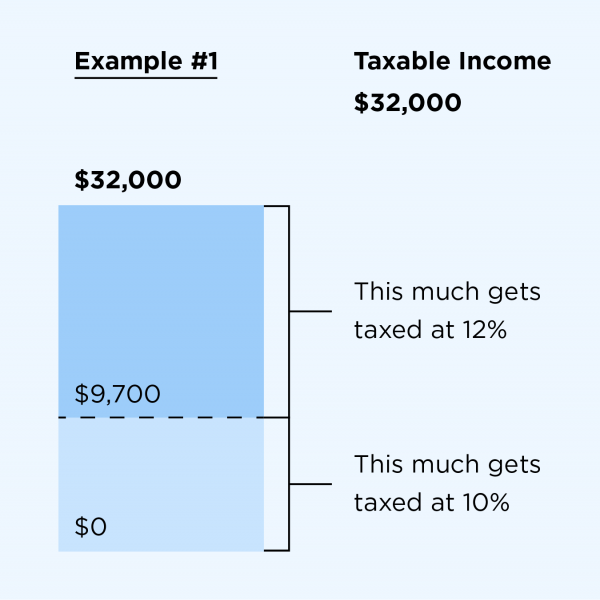

Understanding what tax bracket you fall into will help you determine whether you need to make estimated tax payments, adjust the amount of tax withheld from your paycheck, or how much of that pay raise will be taxed at the next bracket. The percentage of tax that is paid in each bracket is of course lower than the federal brackets (though California state income taxes are among the highest in the country). The tax brackets used to calculate how much you will pay in California state income tax operate similarly to the federal income tax brackets taxpayers with lower earnings pay less in taxes while those with higher earnings will climb the brackets.

0 kommentar(er)

0 kommentar(er)